Transparency is key, and any changes made should be well-documented and easily traceable. Deleting undeposited funds in QuickBooks requires careful consideration and accurate adjustments to ensure that all financial records remain consistent and transparent. Fixing undeposited funds in QuickBooks Online requires a systematic approach to identify and resolve any discrepancies or issues related to pending payments and deposits.

This feature allows you to group together multiple payments before recording a bank deposit. Following these steps will enable you to effectively clear undeposited funds in QuickBooks Online, ensuring that your customer payments are properly recorded and deposited into your bank account. Regularly performing this task will keep your financial records accurate and up to date. Identifying and addressing undeposited funds is crucial for financial accuracy, as it ensures that all income is properly recorded and accounted for.

Deposit payments into the Undeposited Funds account in QuickBooks Online

Be sure to verify that the funds have been correctly allocated before finalizing the clearing process in QuickBooks Desktop. This not only promotes transparency and accountability but also aids in accurate cash flow management and budgeting. This categorization plays a crucial role in maintaining accurate financial records, as it allows for clear differentiation between funds held in transit and those already deposited.

OpenStack Backup and Recovery Software

- Quickbooks Online allows users to directly link undeposited funds to bank deposits, streamlining the process and providing a more accurate reflection of cash flow.

- As it goes with all the software, there’s always a demanding learning curve.

- I suggest checking your bank statement if the funds have already been transferred.

- However, if you connect your bank and credit card accounts to QuickBooks, it automatically downloads all your transactions.

- Double-check that the deposit to account in the transaction matches the appropriate bank account where the funds were actually deposited.

This process ensures that all funds received are accurately recorded and accounted for, allowing for streamlined financial management. By creating bank deposits, how to calculate unit costs of production the received payments can be consolidated and matched with the corresponding transactions, providing a clear overview of cash flow. Transferring the funds from the undeposited account to the designated bank account simplifies reconciliation and ensures that the financial records accurately reflect the actual funds available. This seamless transfer and organization of funds within Quickbooks Online significantly contribute to maintaining accurate and up-to-date financial information.

So when it comes to accounting software, QuickBooks can be named ubiquitous. It’s a good idea to check your Undeposited Funds account to clear out any payments waiting to be deposited. You’ll decide which account in QuickBooks to put the deposit into when you combine.

The process of clearing undeposited funds in QuickBooks Online involves several important steps to ensure accurate recording and reconciliation of payments. This process involves reconciling the undeposited funds account regularly, which can prevent discrepancies in the financial reports. Unattended undeposited funds may lead to inaccurate financial reporting, which can have detrimental effects on decision-making and overall financial stability. This feature allows businesses to accurately track the flow of funds, ensuring that all incoming payments are accounted for and allocated appropriately. By consolidating funds before they are deposited into the bank, it enhances operational efficiency by streamlining the reconciliations process. This capability strengthens financial insight, enabling businesses to have a clear overview of their cash flow and make well-informed decisions.

How To Record Deposits In Quickbooks Online

By thoroughly reviewing and organizing your transactions in the undeposited funds account, you ensure that you have an accurate and complete record of the payments you intend to clear. This sets the stage for a smooth and accurate clearing process as you move on to the next steps. Once you’re in the undeposited funds account, you will see a list of the payments that have been recorded but not yet deposited.

We will explore the key differences between QuickBooks Online and Desktop, providing you with a thorough understanding of each platform’s unique features and functionalities. Once the bank deposit is saved, QuickBooks Online will create a new transaction to represent the actual deposit into your bank account. This transaction should reflect the details you entered when creating the bank deposit, such as the date, deposit to account, and amount. Organize your transactions by grouping them based on common criteria, such as payment dates or customer names. This can help streamline the process of selecting payments in the next step when creating the bank deposit. After saving the bank deposit, QuickBooks Online will create what you need to know about tax season 2020 a new transaction that represents the deposit in your bank account.

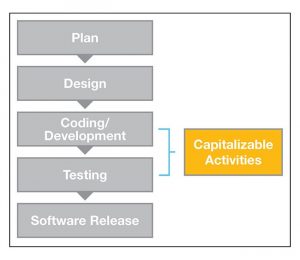

Timely deposits help in preventing discrepancies and errors and ensure that the financial records are in line with the regulatory requirements. Both versions of Quickbooks enable users to consolidate multiple payments received into a single bank deposit, streamlining utility deposits the reconciliation process. In Quickbooks Desktop, the undeposited funds account is a default feature, while in Quickbooks Online, users have the flexibility to choose whether to use this account. We will discuss the benefits of using undeposited funds, such as improved financial management, easier reconciliation, and more accurate reporting. To ensure you are equipped with the best practices for managing undeposited funds, we will cover essential tips for regular reconciliation, proper categorization, and timely deposits.

To start the process, navigate to the ‘Plus’ icon on the Quickbooks Online dashboard and select ‘Bank Deposit’. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. The options (Save, Print, Email the Sales Receipt) are in the ribbon, so you can choose whether you want to print or email the sales receipt immediately or in a batch later on. Let’s look at them in more detail to get a better hold on how to work with the Undeposited Funds Account in QuickBooks.